OECD Debt Data Transparency Initiative

Data management and reporting to enhance transparency in private sector lending to low-income countries

29/03/2021 – The COVID-19 pandemic has prompted a renewed focus on data transparency to better assess and address debt sustainability, particularly for the world’s poorest and most vulnerable countries. In addition to the direct impact of the pandemic on the healthcare systems, declining revenues present an ongoing threat to growth in these countries, and to their ability to service their debt. The G20 Debt Service Suspension Initiative (DSSI), which calls on both official and private creditors to offer forbearance to eligible countries that request it, has also underscored the key role of transparency in sovereign debt markets.

An adequate improvement to the transparency related to existing debt transactions, terms and conditions could help avoid macroeconomic stability risks. In this context, the IIF Voluntary Principles for Debt Transparency are designed to enhance transparency in private sector lending, particularly to vulnerable low-income countries.

Promotion of transparency of debt data has become an important issue in the international community, fostered by several initiatives such as the ‘OECD sustainable lending principles for official export credits’ and the ‘G20 operational guidelines for sustainable financing’ which are widely supported by G20 members. Moreover, the G20 has supported the implementation of the Voluntary Principles during the past two G20 presidencies. The Principles have taken on additional meaning since the DSSI, and its full operationalisation could help make the international coordination and negotiations of debt servicing and suspension, or similar negotiations under the G20 Common Framework, fairer and more durable to improve borrowers’ debt sustainability.

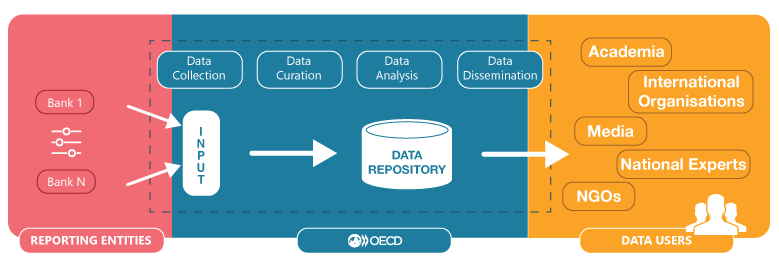

The OECD, with the support of the UK government and the IIF, is now embarking on a Debt Transparency Initiative to operationalise the Voluntary Principles for Debt Transparency so that relevant debt data is collected, analysed and reported. This will allow any interested stakeholder to benefit from a better understanding of the debt levels and conditions of vulnerable countries.

The multi-phased project, the launch of which was announced by the Secretary General at the meeting with Heads of State and Government on the International Debt Architecture and Liquidity on 29 March 2021, seeks to bring together data providers that lend to low-income and emerging market countries and data users. Providing timely, aggregated data on lending, pricing, and other terms can help better assess levels of sovereign indebtedness in countries that may be more fragile to changes in interest rates, and exogenous shocks that can destabilise countries. The project will utilise the following key working efforts:

- Development of a digital platform which will serve to both receive and disseminate data on forms sovereign debt of low and emerging market countries

- A process for lending entities to report in a transparent and user-friendly manner, which is a key principle of the IIF principles

- Analysis and report on data trends and implications

- Engagement with a broad range of stakeholders on debt transparency through an Advisory Board for Debt Transparency, which will be established under the OECD Committee on Financial Markets, whose members include central banks, finance ministries and international organisations

The Debt Transparency Initiative resides in the OECD Financial Markets Division, and it will rely on a data platform – the Debt Transparency Database – powered by the .Stat Suite, an open source solution developed under the OECD-led Statistical Information Systems Collaboration Community (SIS-CC).

The Debt Transparency Database

The OECD is starting work on a platform that will support:

- reporting by lending entities (financial institutions reporting on individual transactions)

- data quality assurance and analysis by OECD

- dissemination of the data in various shapes

The sketch above summarises the platform concept and this will be complemented as the platform features are conceived and then developed. Services offered to reporting entities and main data dissemination features offered by the platform will be documented in later stages.

The cornerstone of the platform is the data matrix, which describes the data reported and its characteristics. A preliminary draft data matrix is provided for illustration, and may be subject to further modification following the consultation with providers and users. The note explains the nature of the matrix, how it derives from the IIF Voluntary Principles for Debt Transparency, how the reporting entities are expected to fill it in, and how the OECD intends to use the data gathered.