EMEA President, Prof. Rym Ayadi, highlights the importance of debt transparency at the webinar “Atlantic approaches to global challenges”

The President of EMEA, Prof. Rym Ayadi was one of the speakers of the webinar “Atlantic approaches to global challenges: Sustainability, recovery and new security threats” which took place online on 28 and 29 June 2021. Prof. Ayadi participated at the panel “Transborder Economic Flows from an Atlantic Perspective: Post Covid-19 Economic Recovery: is there…

EMEA Debt Transparency Platform is enhanced with debt data of Ghana

A new set of data from Ghana have been included in the EMEA Debt Transparency Platform (DTP), which now presents individual debt transactions data from two African countries, Angola and Ghana. On the occasion for the addition of the new data set, EMEA President, Prof. Rym Ayadi, underlined that “debt transparency is cornerstone to effective…

EMEA announces the webinar “Debt Transparency and Infrastructure Development for Resilient Recovery in Africa” scheduled on Tuesday 22 June 2021, 15:00 CET

The focus of this webinar is to discuss debt transparency and infrastructure development and financing mechanisms for COVID-19 recovery in Africa. The discussion will be Africa specific and tackle issues such as new financing mechanisms to fund resilient development, debt relief measures focusing on the Common Framework, the role of the international organisations (e.g. IMF…

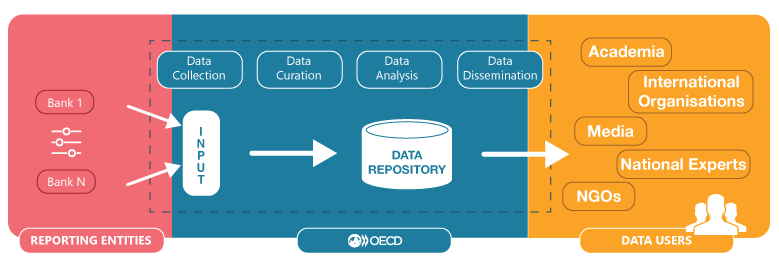

OECD Debt Data Transparency Initiative

Data management and reporting to enhance transparency in private sector lending to low-income countries 29/03/2021 – The COVID-19 pandemic has prompted a renewed focus on data transparency to better assess and address debt sustainability, particularly for the world’s poorest and most vulnerable countries. In addition to the direct impact of the pandemic on the healthcare…

IMF COVID-19 Emergency Loans: A View From Four Countries

Have governments of Cameroon, Ecuador, Egypt and Nigeria carried through on anti-corruption measures included in their loan agreements? The International Monetary Fund (IMF) initially pledged to use its US$1 trillion lending capacity to help countries cope with the most serious health and economic crisis in recent history. It has approved only 10 per cent of this amount,…

EMEA supports Transparency International petition to end anonymous shell companies

The Euro-Mediterranean Economists Association (EMEA), represented by its Founder and President, Professor Rym Ayadi, signed the petition of Transparency International for an end to the abuse of anonymous companies, joining the call for the UN General Assembly Special Session against Corruption, UNGASS 2021, to commit all countries to set up central, public registers of beneficial…

EMEA participation at the Sovereign Debt meeting of the Financial Markets Law Committee (FMLC)

Prof. Rym Ayadi, Professor at The Business School (formerly Cass) and President of EMEA, and Prof. Emilios Avgouleas, Chair International Banking Law and Finance, University of Edinburgh, member of the Sovereign Debt Group of FMLC, and member of EMEA Advisory Board, were invited at the Sovereign Debt Scoping Forum of the Financial Markets Law Committee…

Preventing and Managing Debt Crises: The Role of Debt Transparency

Amidst calls for debt relief to mitigate the socioeconomic consequences of COVID-19 in Africa, debt transparency has become an even more pressing issue, in view of the recent wave of debt suspensions under the Debt Service Suspension Initiative (DSSI) and calls for Private Sector Involvement (PSI). This paper assesses the key risks stemming from debt…

EMEA webinar report: “Reforming International Debt Architecture: Can Debt Transparency Be Achieved for Africa” – 22 October 2020

The focus of the webinar was to discuss the role of debt transparency in reforming the international debt architecture. The discussion was Africa specific and tackled issues such as sovereign defaults and debt relief measures, the role of the international organisations (e.g. IMF and the EU), the private sector and the potential path towards debt…

New EMEA policy paper – Making Transparency Pay: Designing the Right Incentives for Debt Managers in Africa

This policy paper proposes the introduction of a variable remuneration component for debt managers in Sub-Saharan Africa and other less developed countries characterised by relatively underdeveloped institutional capacity and governance standards. The aim is to improve debt management outcomes and public debt transparency by aligning the interests of decision makers with those of the public.…